Insurance Fraud Unit

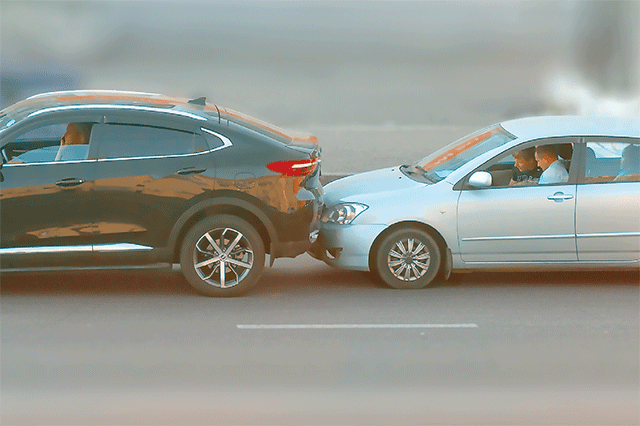

The Sonoma County District Attorney’s Insurance Fraud Unit prosecutes all forms of insurance fraud and related crimes, including Workers’ Compensation Fraud and Automobile Insurance Fraud. The Unit works closely with the California Department of Insurance and the fraud units of various insurance companies, other District Attorney’s Offices, and other local agencies to investigate and prosecute these crimes.

It is the Fraud Unit’s mission to investigate fraudulent claims and aggressively prosecute violators, thereby deterring others from similar conduct by demonstrating its consequences.

Translate

Translate